Everything about Paul B Insurance

Wiki Article

Not known Details About Paul B Insurance

Table of ContentsFascination About Paul B InsuranceLittle Known Facts About Paul B Insurance.Paul B Insurance Things To Know Before You BuyThe Best Strategy To Use For Paul B InsuranceThe Buzz on Paul B Insurance

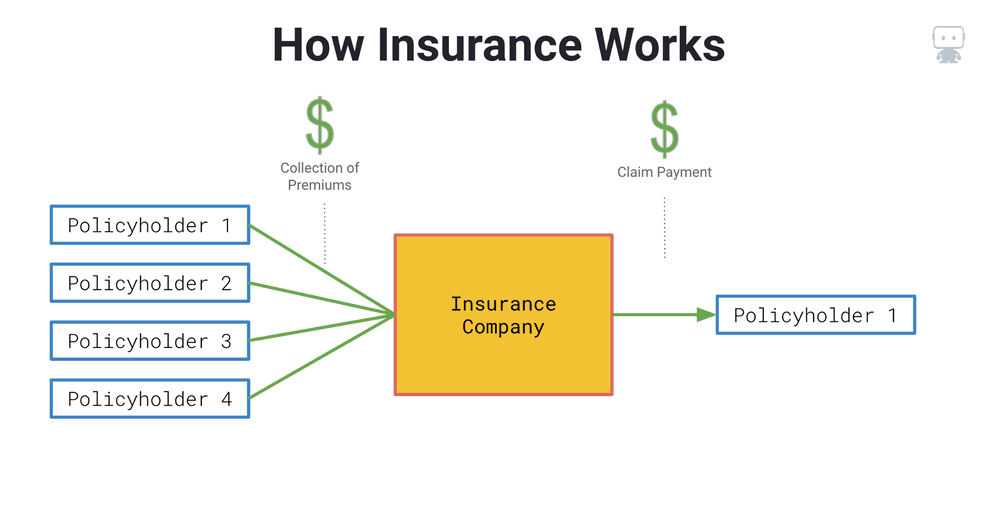

The thought is that the cash paid in claims in time will be less than the overall premiums accumulated. You may seem like you're throwing cash gone if you never sue, but having piece of mind that you're covered on the occasion that you do endure a significant loss, can be worth its weight in gold.Envision you pay $500 a year to insure your $200,000 residence. This suggests you have actually paid $5,000 for home insurance.

Due to the fact that insurance is based on spreading the danger among lots of people, it is the pooled cash of all individuals spending for it that permits the company to build possessions and cover claims when they take place. Insurance policy is a service. Although it would be great for the firms to just leave rates at the same degree at all times, the reality is that they have to make sufficient cash to cover all the possible insurance claims their policyholders may make.

The Greatest Guide To Paul B Insurance

just how much they entered premiums, they must change their prices to earn money. Underwriting adjustments and also price rises or decreases are based upon outcomes the insurance provider had in previous years. Depending upon what business you buy it from, you might be managing a restricted agent. They sell insurance coverage from only one firm.The frontline people you deal with when you acquire your insurance are the representatives and brokers who stand for the insurance provider. They will explain the sort of items they have. The restricted agent is an agent of just one insurance provider. They an accustomed to that company's items or offerings, but can not talk in the direction of various other business' plans, prices, or item offerings.

Not known Facts About Paul B Insurance

The insurance coverage you need differs based on where you are at in your life, what type of possessions you have, as well as what your long term objectives as well as responsibilities are. That's why it is essential to put in the time to review what you want out of your plan with your representative.If you take out a car loan to acquire a car, and after that something happens to the vehicle, gap insurance will certainly repay any section of your lending that basic automobile insurance does not cover. Some lending institutions need their debtors to lug gap insurance policy.

The Greatest Guide To Paul B Insurance

Life insurance policy covers the life of the guaranteed individual. The policyholder, that can be a various individual or entity from the insured, pays costs to an insurance why not try this out provider. In return, the insurer pays an amount of money to the recipients provided on the plan. Term life insurance policy covers you for a time period selected at acquisition, such as 10, 20 or thirty years.If you do not pass away during that time, nobody makes money. Term life is popular since it provides large payouts at a lower expense than irreversible life. It likewise supplies protection for a set variety of years. There are some variants of regular term life insurance policy policies. Exchangeable policies enable you to transform them to irreversible life plans at a higher premium, enabling for longer and possibly a lot more adaptable protection.

Irreversible life insurance policies build money value as they age. The money value of whole life insurance coverage plans expands at a set rate, while the cash money value within global plans can rise and fall.

Some Known Questions About Paul B Insurance.

If you compare ordinary life insurance policy prices, you can see the distinction. For instance, $500,000 of whole life protection for a healthy 30-year-old woman prices around $4,015 yearly, typically. That same level of coverage with a 20-year term life plan would cost approximately about $188 yearly, according to Quotacy, a brokerage company.Those financial investments come with more risk. Variable life is one more long-term life insurance policy option. It appears a great deal like variable global life but is really various. It's a different to whole life with a fixed payout. Nevertheless, insurance policy holders can make use of investment subaccounts to grow the Learn More Here money value of the policy.

Right here are some life imp source insurance coverage basics to help you better understand how insurance coverage functions. For term life plans, these cover the expense of your insurance coverage and management costs.

Report this wiki page